Starting and running a business is very exciting. Of course, you need to put in a lot of hard work, but at the end of the day, you can look back with satisfaction.

Most service-based businesses are small and owned by a few private individuals or partners. Profit margins are important, even more important than expansion because

- Most need a profit to keep the business running

- The profit margins a business makes determine the owners’ paychecks

- Larger companies with venture capital can afford to lose money for some time, but not small private businesses

Determining the gross margin for service business ventures is not easy. There is a uniqueness to each of these small businesses. For example, some businesses have to focus on sales volumes, which means their gross profit margin is comparatively low. Despite an overall lower gross profit margin, these businesses are financially healthy.

To gain insight into your gross margin for service business you need to look at your competition and business strategies. Without this broader context, it is impossible to calculate gross profit margins and understand them.

What Is a Gross Profit?

There are different terms that experts use to refer to the same or similar things. Sometimes they use the term gross profit margins, and sometimes gross margins, or gross margin ratios. Such metrics are among the most used metrics for evaluating a company’s financial health and market position.

A gross profit margin is expressed as a percentage. This percentage tells you the revenue you generate per dollar. It takes into account the costs you incur for delivering the service or product sale.

The costs associated with your business activities are the COGS. You can express your gross profit margin in the following way:

Gross Profit Margin = Revenue – COGS

Let’s say you generate $250,000 in revenues, and your business costs are $150,000. In that case, your gross profit margin is $100,000.

The formula above is very simple, and you need to know only two things. The problem is that the term for expenses is not always very clear or defined. You need to include every single expense that you spend for your business. Depending on your business, that includes

- Credit cards

- Equipment

- Labor

- Materials

- Sales staff commissions

- Shipping

- Utilities

That is a long list and depending on your situation it could be much longer.

The formula only considers variable costs. There are also fixed costs associated with running a business, and it is important to understand the difference. Some examples of fixed costs include

- Advertising

- Car insurance

- Office supplies

- Rent

- Salaries of production staff

What Is the Difference Between Gross Profit Margin (GPM) and Gross Profit (GP)?

The gross profit margin is the ratio between the gross profit and the service’s revenue. In the case of our example, that is

(100,000/250,000) x 100% = 40%

The gross profit is always in dollars or some other monetary unit. The gross profit margin is always in percentages. In this example, the company earned $0.40 for every $1 spent on services.

Besides their units, gross profit margin and gross profit also differ in their purposes. Yet, both numbers are important metrics. But what is it that changes when you add the word margin?

The gross profit is a measure of the company’s earning capacity. The profit margins give an idea of how efficient the business operations are, which helps the company set more precise goals for future revenue projections.

What Is the Difference Between Gross Profit Margin and Net Profit Margin?

The gross profit indicates the profitability of the services. This is an important metric for the business owner and other stakeholders.

The net profit is a metric that gives insight into the business’ market position and the services’ value. It is also an aid in setting price levels and determining how much it needs to sell to be profitable.

The net profit indicates the performance of an entire organization. This metric considers all operating expenses and, thus, does not measure the services’ success. It rather shows the efficiency of the business owner in running the business and if they can control costs.

Here is an example to illustrate the difference between gross and net. A graphic design company could have a high gross profit margin but lose much of the profit margins because of high overhead costs. The high overhead costs lower the net profit margin.

The company should make efforts to lower the overhead costs. They could do this by renting cheaper office space or improving process efficiency.

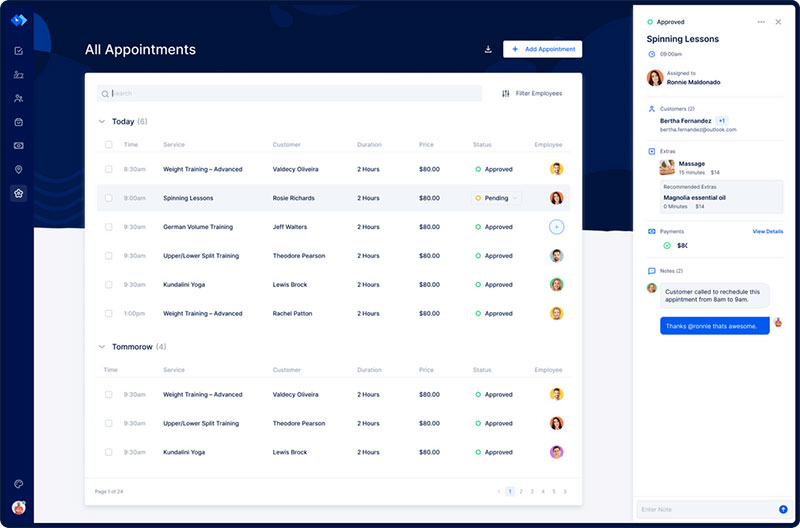

Your success story starts with a scheduling app to streamline your calendar

Staying organized has never been easier.

You can now manage your business and grow your brand with a single, powerful software that keeps all of your appointments in line, your clients organized and your business booming.

Trafft is perfect for business owners who need to streamline their booking experience both for their staff and their clients.

Trafft handles everything for you, even sending automated email or SMS reminders to your clients. No-shows? Not anymore!

The Trafft booking software adapts to different industries for a blissful online booking experience and employee management.

Want to know more? Check out Trafft’s awesome features to see what you are missing.

Ideal Gross Profit Margin for Professional Services Businesses

Now it is time to turn definitions into profitable numbers. What is an ideal gross profit margin for a service-based business?

Because all businesses are different, there is no such thing as an ideal margin. It depends on many factors, such as industry, long-term goals, and development stage.

A standard of a good gross profit margin for your company is the statistics of your competition. If you look into that, you will see that successful businesses will have an average gross profit margin of 30%.

Yet, that does not mean that 30% is the ideal number for your company. As said before, there is no ideal number for all companies. For some, 20% is a good number, and some businesses are successful with 5%.

But businesses with little overhead, like consultancies, will have much higher margins. The average for accountancy offices is 19.8%.

Remember, the gross profit margin doesn’t say much about the success of the business or how much money you can make.

It tells you how much money you can make on every dollar you spend.

Let’s imagine a firm with gross margins of 37.5%. It is a small business with a CFO, a controller, five salespeople, and five marketers.

Yet, they have excess office space in an expensive part of town. It is likely that they are actually losing money, despite the 37.5% profit margin. Their net profit margin is much too high.

Now, think of a similarly sized company. It has an HR leader, a marketing person, and an external accountant, but this company’s employees work from home. That means that they have very few overhead costs, and it will thrive considering a 37.5% gross profit margin.

Where to Measure Gross Margin

There are three major operating levels that form part of the gross profit margin calculation. These are

- Individual projects

- Practice or project types

- Firm

Below is a discussion of each of these levels.

Individual Project Level

You can calculate the gross profit margins for each individual project. That allows you to compare the profitability of each project. If you have a project with a margin of 35% and a similar one with 15%, there is likely a problem with the second one.

It is important to compare similar projects. It is also important to compare the projected and actual gross profit margins of each project.

Comparing the margins of differing projects is not very practical. Different projects have different costs and different outcomes. You can justify this by considering that there is a higher or lower risk involved with each project as well.

Practice or Project Type Level

Evaluating this level is important for larger service companies with different project types. Take the example of a management consultancy firm. It may have a Spending Optimization department and a Mergers and Acquisitions department. It is good to compare the function of both departments.

Firm Level

The gross profit margin at this level reflects the overall success of a company’s services sold. It covers revenues and costs over a certain period of time. Business owners can use the number to compare the different financial periods. These are often divided into three-month periods.

Improving Your Gross Profit Margin

Improved gross margins mean more income for the business owner. Here are some areas where you might be able to make some improvements.

Update Your Prices

Sometimes you may notice, some services are not as profitable as hoped. A good suggestion is to review your price levels. It may be tempting to increase the price, but that is not always the best thing to do. In fact, there are many factors to consider. When you do decide to ask for a higher fee, you may need to consider refining your offers too.

Decrease Expenses

This is a logical conclusion from the discussion above. You could review your suppliers to find cheaper alternatives. Have a look at your other expenses as well. You might notice that there are several non-essential ones. Cutting non-essentials will increase your profit margin.

Other opportunities for decreasing expenses are insurance and specialized business software. These are expenses that are often negotiable with the providers.

Be Innovative and Find New Niches

A predominant part of being successful in the service industry is being creative and finding a special niche. A company’s marketing team plays a vital role in this process. They are the ones that conduct market research and product analysis to determine available opportunities.

Focus on High-Margin Projects

Every now and then business owners should review their services, and see which ones are most profitable. They should focus on the best ones, and cut the ones that contribute the least to the gross margin for service business companies.

To gain insight into profitability, a business owner can research the margins of competitors. That also helps to establish competitive prices.

Optimal Gross Margin for Service Businesses

Business decisions are impossible without information on gross margins for service business averages.

To grow, you need a motivated sales team, to give them the right tools, and keep an eye on the latest sales trends. Insight into gross profit margins and net profit margins helps you to know how you can grow and increase your income.

Company owners need to have close communication with their CFOs and controllers. They are the ones that can keep accurate track of the margins across the organization.

FAQs about the gross margin for service businesses

1. What is the gross margin for a service business, and how is it calculated?

The difference between the income received from providing services and the direct costs related to doing so is known as the gross margin for a service business.

It is computed by dividing the total revenue by the cost of goods sold (COGS), which is subtracted from the revenue total. The equation reads as follows: (Total Revenue – COGS) / Total Revenue equals gross margin.

2. How does gross margin differ from profit margin in a service business?

Both gross margin and profit margin are metrics of profitability, however, profit margin includes all costs, including indirect costs like overhead, taxes, and interest, whereas gross margin just takes into account direct costs.

Profit margin presents a more thorough picture of the company’s entire financial performance than gross margin, which sheds light on the profitability of a service business’s main operations.

3. Why is gross margin important for service businesses, and what does it indicate about the business’s financial health?

Because it gauges the profitability of providing services, gross margin is a crucial financial metric for service-based organizations. Businesses can use it to pinpoint inefficient regions and concentrate on enhancing cost-control strategies.

While a low gross margin may point to operational inefficiencies or unresolved pricing concerns, a high gross margin suggests a company is making a healthy profit from its services.

4. How can a service business increase its gross margin?

By applying cost-control techniques, refining pricing tactics, and enhancing the effectiveness of service delivery, service organizations can raise their gross margin.

Reducing waste, negotiating better supplier contracts, raising productivity, or raising the caliber of services offered are a few examples of how to do this. While implementing cost-cutting initiatives, it is crucial for firms to take into account the effects of any changes on customer satisfaction and retention.

5. What are some common factors that can affect a service business’s gross margin, both positively and negatively?

Competition, shifts in consumer demand, price sensitivity, shifts in the cost of goods or labor, and seasonality are some frequent elements that can affect a service business’s gross margin.

Gross margin can be positively impacted by factors like improved production or efficiency, price increases, or economies of scale. Increased costs, more competition, and changes in market circumstances are all causes that could harm gross margin.

6. Is there an ideal or typical gross margin range for service businesses, and how does it vary by industry?

Depending on the sector and type of organization, there are several ideal or typical gross margin ranges for service businesses.

While some service companies may have better gross margins because of minimal overhead or distinctive services, others may have lower margins because of intense competition or high prices.

The gross margin should, as a general rule, be high enough to cover operating expenses and yield a respectable profit.

7. How does a service business’s gross margin affect pricing decisions and strategies?

Making price decisions for services requires careful consideration of gross margin. The requirement for service businesses to make a healthy profit must be balanced with the need to maintain their competitiveness.

Businesses can maximize their gross margin and profitability by using pricing strategies that account for the cost of providing services, competition, and customer value.

8. How can a service business benchmark its gross margin against similar businesses in the industry?

By investigating and examining the financial information of comparable companies, service businesses can compare their gross margin to industry norms.

This can be accomplished by using publicly accessible data, industry reports, or benchmarking activities with colleagues in the industry. To guarantee accurate and insightful comparisons, it is crucial to make sure that businesses of comparable size, geography, and service offerings are used.

9. What are some potential risks or challenges that can arise when trying to improve a service business’s gross margin?

While attempting to boost a service company’s gross margin, some potential risks or difficulties can include pricing pressure from rivals, decreasing customer satisfaction as a result of cost-cutting initiatives, and decreased employee morale as a result of elevated productivity demands.

Also, it could be questionable whether adjustments made to increase gross margin would have the desired effect and may take a lot of time or money to implement.

10. How does a service business’s cost structure impact its gross margin, and how can businesses optimize their costs to improve profitability?

The gross margin of a service firm can be strongly impacted by the cost structure of that business, which includes direct expenditures like personnel, materials, and equipment as well as indirect costs like marketing, rent, and utilities.

By carefully examining their cost structure, discovering inefficiencies or waste, negotiating better prices with suppliers, and increasing productivity, businesses can reduce their expenses. Businesses can boost their gross margin and overall profitability by cutting costs.

If you liked this article about the gross margin for a service business, you should also check out this one with service business examples.

We also wrote about similar topics like how to value a service business, how to start an answering service business, how to start a tree service business, the most profitable service businesses, home service businesses you can try, and the KPI for a service company to monitor.