How to value a service business is an important skill. Knowing the value of your business is vital when you want to buy, sell, or pass the business on to a family member.

You can do a business valuation in different ways, and there is no single right way. However, at the same time, you can do it wrong. The exact value of your business depends on what it is worth to you and many different other criteria.

The fact that there are many approaches could be confusing. But you can also use this to your advantage. This post shows how to value a service business in different ways. You can apply a mix of approaches and use them to derive a business valuation estimate.

What Is Business Valuation?

Company or business valuation is the process of estimating a company’s total asset and business value. This can be a lengthy process, as all aspects need evaluation. A valuation like this can be for an entire organization or one or more departments within it. Purposes of the valuation include determining a company’s value for a sale or acquisition or for tax reporting.

The valuation result represents the company’s total value. To calculate a business valuation, you need to take at least the following into account:

- Assets

- Debts or losses

- Earnings

- Industry

The exact outcome of a business valuation is very important for entrepreneurs who want to buy another business. Many acquiring parties determine the market value of a company independent of the selling party or broker.

The Difference Between Book Valuation and Fair Market Valuation

What Is Book Value?

The book value of your business looks at the assets your company has and subtracts liabilities, such as debts, from that.

Your business assets include everything your business owns. That includes things like equipment and inventory. After all, someone that wants to start a similar business would have to invest in all that. Your business value includes at least all the replacement costs. To figure out what your company’s assets are worth, it is good to look at the balance sheet in your report creator. That will give you some indication.

Yet, most companies cost more money than their book value only. So why the difference? That is because the balance sheet only shows what the original cost of the assets was. That does not take into account inflation and depreciation. What is in the books is thus not the actual replacement value.

What Is Fair Market Value?

The hard numbers of the book value are not always a good representation of the actual value of your business. The value of your business also depends on the market. Also, you will have to compromise if you are anxious to sell and do not want to wait.

If you are struggling because your entire industry is struggling, you will have to lower your price if you want to be able to find an interested buyer.

If your industry is doing well, there will be more buyers and you can raise your asking price. The market value will increase if your business offers a unique product, service, or something else. Some industries that are in high demand are:

- Internet, web, and cloud-based services

- Information technology

The business’s worth increases if your business is not stuck to a specific location and has low overhead. Flexibility and scalability are important factors.

In general, business-tob-business models have a higher average market value than business-to-consumer companies. For both, it is true that prospective clients prefer client diversity. Many smaller and medium-sized clients are better than a few big ones. In this way, the financial risks get spread over a larger number of clients. The impact of losing one customer is much larger if there are only a few clients.

How to Value a Service Business: Valuation Methods

The Value of Assets

The first method that addresses how to value a service business considers the business assets. A well-known method is the Adjusted Net Asset Method (ANAM). It considers intangible assets and tangible assets, including inventory and property. Then it subtracts the liabilities to determine the business worth. It includes an adjustment for the fair value market, which is essential when you decide to sell your business.

ANAM is also great for internal use. It helps to keep control over capital resources and spending.

For a small business, it is enough to make a list of all intangible and tangible assets. You can then assign a monetary value to them. For most equipment, the actual value lies somewhere between the depreciated and original value. That number often corresponds to the price that that piece of equipment would sell for.

Capitalization of Earnings

A cruder value estimation is revenue. A company could have annual sales of $150,000, which corresponds to a revenue stream of $150,000. You can think of the estimated value as a multiple of how much revenue a company generates.

What this multiple is depends on the industry and business. A typical sales price could be one or two times the annual revenue value. A good stockbroker can help you find out what reasonable multiples are for your industry. A professional business appraiser can also help you determine what your business valuation amounts to.

The capitalization of earnings or revenue method works well for online service businesses. More information, though, will give you a more accurate valuation. Then, it might allow you to base the number on the business’ assets as described above.

Earnings Multiplier

The earnings multiplier method is a more accurate valuation method than the revenue method. This is because profits are a more accurate measure of the business’s success and thus of the business’s worth.

To do this, you need to calculate the future profits, considering the expected investments and current interest rate. In other words, you adjust the current price-to-earnings (P/E) ratio for interest rates.

With the adjusted P/E rate and projected earnings, you can calculate the business’ worth. Supposing the projected earnings are $150,000 and the P/E is 12, the business valuation would be $1,800,000.

Discounted Cash Flow Analysis

Many investors consider the cash flow to be the most important parameter when they buy. Cash flow is important because it is necessary to pay off loans and keep working capital.

The importance of cash flow is even more emphasized in the case of service business valuation. This is because there are few other costs related to the business itself.

Investors adjust the cash flow projection according to the risk associated with the acquisition of the business. This projection is most favorable for new businesses with large potential but that haven’t managed yet to be profitable.

This method of estimating a business’s value is useful for assessing businesses with volatile earnings. The starting point is gathering earnings information for the last couple of years. The numbers are then adjusted for inflation and other market factors, and forecasts are calculated.

The advantage of discounted cash flow over other valuation methods is that it gives a better reflection of future results. It includes the business’s ability to generate liquid assets in the future. The disadvantage is that it relies on the terminal value. This value varies according to the assumption you make about discount rates and growth potential.

Market Approach

The numbers are a good indication, but you need to consider the market value too. These considerations include factors such as geographical location and potential strategic value. Potential buyers are more interested in future potential than past results.

The market approach helps you to establish a selling or buying price based on the local market. This business valuation method works for any kind of business. It requires that you do research into your industry in your area. You need data to compare your company with. This will work very well if you are the business owner of a growing business in a booming industry.

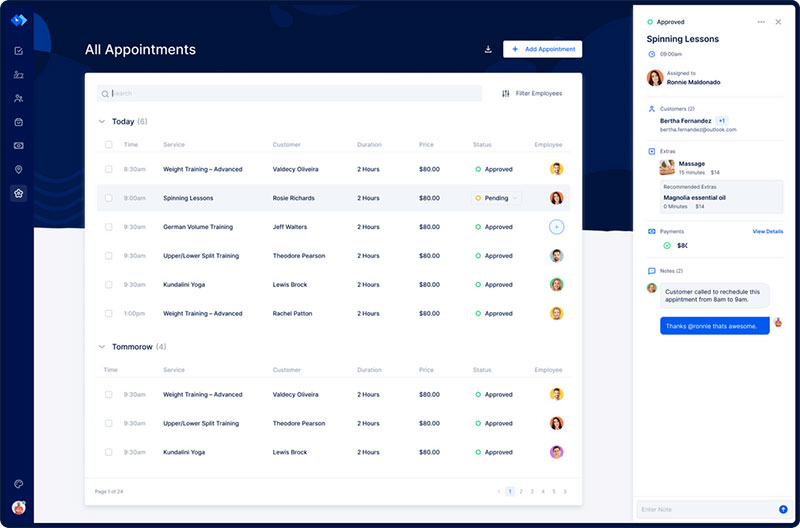

Your success story starts with a scheduling app to streamline your calendar

Staying organized has never been easier.

You can now manage your business and grow your brand with a single, powerful software that keeps all of your appointments in line, your clients organized and your business booming.

Trafft is perfect for business owners who need to streamline their booking experience both for their staff and their clients.

Trafft handles everything for you, even sending automated email or SMS reminders to your clients. No-shows? Not anymore!

The Trafft booking software adapts to different industries for a blissful online booking experience and employee management.

Want to know more? Check out Trafft’s awesome features to see what you are missing.

FAQs about valuing a service business

1. What is a service business valuation?

The process of figuring out the economic worth of a business that offers services, including consulting, marketing, or legal services, is known as a service business valuation. Several aspects, including revenue, profitability, market conditions, customer base, intellectual property, and management team are considered in the value.

2. How is the value of a service business determined?

Analyzing several financial and non-financial factors, such as revenue growth, profitability, customer retention, market rivalry, service quality, scalability, intellectual property, and management team, helps establish the worth of a service organization. Depending on the nature of the firm and the goal of the valuation, numerous approaches and procedures may be used.

3. What are the key factors that impact the value of a service business?

Revenue growth, profitability, customer retention, market competition, service quality, scalability, intellectual property, and management team are the main elements that affect a service business’ value. These elements are crucial in establishing the company’s potential for long-term success and growth.

4. How do you calculate the value of a service business?

Several methods of valuation, including discounted cash flow analysis, market comparables, and asset-based methodologies, can be used to determine the worth of a service business. The approach taken may vary depending on the industry, scale, future growth, and other elements that affect the value of the company.

5. What are some common valuation methods used for service businesses?

Discounted cash flow analysis, market comparables, precedent transactions, and asset-based methodologies are common valuation techniques for service organizations. Depending on the type of business and the valuation’s objectives, each method has advantages and disadvantages and may be preferable in some situations.

6. What are some typical multiples used in valuing service businesses?

Revenue multiples, EBITDA multiples, and price-to-earnings ratios are common multiples used to value service organizations. The multiples employed may vary depending on a number of variables, including market conditions, firm size, industry norms, and growth expectations.

7. What are some challenges in valuing a service business?

The intangible character of the firm, the difficulty of estimating the value of the intellectual property and client connections, and the reliance on key individuals are some difficulties in valuing a service business. Also, the worth of the business may alter due to changes in the market or the industry, making it difficult to determine an exact valuation.

8. How does the profitability of a service business impact its value?

A service company’s profitability can have a big impact on how much it is worth. If all else is equal, a highly lucrative service business will probably be valued higher than a less profitable one. Profitability measures like EBITDA and operating margin are frequently used by investors and prospective buyers to evaluate the financial health and market value of service businesses.

9. How does market competition impact the value of a service business?

Market competition has a variety of effects on a service business’s value. Low prices, slim profit margins, and high client acquisition expenses can all have a detrimental effect on a company’s value in a highly competitive industry. On the other hand, a service company that controls its market may be worth more as a result of the possibility for greater pricing power and market domination.

10. How can a service business increase its value?

By strengthening its financial performance, raising the standard of its services, growing its clientele, creating new revenue streams, and utilizing its intellectual property, a service business can raise its value. Investing in technology, assembling a solid management team, and using successful marketing techniques to draw in new clients are further approaches to boost value.

Conclusion on How to Value a Service Business

You will have noticed that the question “how to value a service business” is multifaceted. As a business owner, you do well to use different methods and combine the results to reach a final number. Doing that will add to the accuracy of your business’s value.

Accuracy is important. If the estimated business value is too low you will lose money. If it’s too high, you may never sell your business. Follow the valuation methods discussed here, and know what your business is worth.

If you liked this article about how to value a service business, you should also check out this one with service business examples.

We also wrote about similar topics like the gross margin for a service business, how to start an answering service business, how to start a tree service business, the most profitable service businesses, home service businesses you can try, and the KPI for a service company to monitor.