You established a business selling services. It did well and amassed a loyal client base, but now you’re planning to sell. Maybe you’re looking to invest in a new venture and need to boost your capital, or you’re wanting to grow professionally in a different direction. Perhaps you just want to retire; the reasons could be diverse.

There are many points to consider before going ahead with the sale, from the timing of the deal to the organization of the sales process.

You know how to run your “Main Street service company”, and you want the best price for it, but you’re not so clued up on the how-to of selling it. Take a look at some vital points and suggestions on how to sell a service business.

Timing of the Sale

The success of a sale comes down to good preparation. You should begin at least two to three years in advance of the desired sale date. The preparation includes upgrading the financial records, the list of clients, and the business framework. These enhancements in your service business not only increase profitability but facilitate the sales transition for the interested parties and will ensure the business keeps operating efficiently.

Timing can make or break the sale of your service-based company since only 20-30% of businesses looking to sell are successful. An owner wants to sell when the business is running at its optimum, and a prospective buyer is interested in a business boasting growth and profit. Pundits warn against a quick sale as you risk missing out on a favorable profit.

The market fluctuates often, so make sure to stay up-to-date with the latest trends. This will enable you to promote your service business to the fullest degree. Some make the mistake of selling when a disaster hits the business. Often in such a market prospective buyers do not value the company, and this can result in a serious price markdown.

Get the Proper Valuation

A great deal of planning goes into selling a service business. Find out what potential buyers consider to be crucial assets in determining the company’s value.

When appraising your service business, keep the following in mind:

- The quality of both present and future clients.

- The prominence of the company’s trade name.

- The company’s current asset value.

The auditor will consider several variables to establish opportunities and confirm a reasonable selling price. This includes gaining a comprehensive view of stock, sales, debt, and company assets.

The value of most businesses generally surpasses profit 2-10 times depending on the industry. Smaller businesses (under $3 million), usually average 2-3 times the profit, medium-sized businesses ($3 million-$20 million) can attain 3-5 times the profit, and a large service-based business ($20 million and above) can hit figures anywhere between 5-10 times that of the profit.

Prepare Your Financials With Your Accountant

Service businesses, big and small, need to make a profit to keep running, and they need to keep good financial records to prove their profits. Financial records should feature valuable information from the past three years, such as statements showing profits and losses, balance sheets, and tax returns. The business broker will prepare a marketing package for the service business which would include a cash flow statement.

As the owner, you need to list all equipment and stock included in the sale, intellectual property, and other intangible assets. It is also advisable that you present the potential buyer with a business operation manual detailing how the business is run. Turnkey operations are a very attractive investment to a potential buyer.

Boost Your Service Business Sales

An excellent revenue stream bolsters the value of the business, making it attractive to buyers. However, should sales hit a plateau, or worse, decline, buyers will not want to pay money for a company that can’t deliver.

It’s integral to work along with the right people who can help you navigate the selling of your business. Find a good accountant, lawyer and business broker that efficiently manage their respective roles, leaving you to focus on boosting sales.

Keep these tips in mind if your aim is to create, expand, and ultimately, sell your service business:

- A business should grow along with the selling services market or industry.

- Grow your base of satisfied customers.

- Enhance your business’ presence both online and on social media.

- Establish what sets your business apart and showcase it.

- Branding is everything; it’s how your customers identify you among the competition.

- Your business plan should contain an exit strategy.

For the majority of buyers, a business’ long-term success can be gauged by taking a look at sales and profit records. It’s no surprise that buyers are interested in service companies with yearly sales of at least 30 percent. Knowing how to sell a service business means knowing that potential buyers want a business that is booming, not scraping by.

Should You Use a Business Broker?

You can save money and avoid business broker commission fees by selling the company yourself. Avoiding a broker is often the choice when potential buyers are either family members or current employees.

A broker allows you to focus your time on running the business while they work to get you the best price. They will aim for a fair price and conduct the sales process with the utmost discretion because it means a substantial commission for them. Remain in frequent communication with your broker to review expectations and marketing strategies for the sale.

The following are some procedures the broker can assist you with:

- negotiation, due diligence, and a business evaluation.

- guarantee a successful closure by facilitating due diligence related to the sales process.

- expanding the buyer’s pool by showcasing your business in multiple marketplaces, pinpointing and marketing to potential buyers.

- use their connections to various financial institutions and private financiers to support buyers in obtaining financial backing.

- assist in negotiating the desired terms of sale.

- thoroughly scrutinize each potential buyer and guarantee confidentiality during the sale.

The majority of deals prove unsuccessful because of negligence regarding how to sell a service business. There are many online business brokerage services that you can use for support. A capable broker will direct you and keep you updated while you concentrate on business operations.

Find Prequalified Buyers

The sale of service businesses can range from six months to two years. This is due in part to how difficult it can be to attract a suitable buyer. Strong advertising can draw more interested buyers.

If you have some possible buyers lined up, keep the sales process in motion with the following:

- Keep in touch with potential buyers.

- Have two or three buyers in place in case the initial deal falls through.

- Check if the interested party prequalifies for funding before disclosing company details.

- Discuss the specifics with a lawyer or accountant if you are funding the sale.

- Enable space for negotiation, but stick to your guns on a fair price, taking into account the future value of the business.

- All potential buyers should sign a non-disclosure agreement to ensure the protection of private business details.

- Place the signed purchase agreement in escrow.

- Consider buyers’ offers, and negotiate using expectations related to the pricing and other vital information.

The sale price is determined by money generated through the business. If there is no revenue, then the price is set on the value of assets. If there is some income, the price is determined by the seller’s discretionary earnings. If there is a substantial amount coming in, pricing will be based on EBITDA.

A buyer is afforded 60-120 days to confirm financial records and the accuracy of information received.

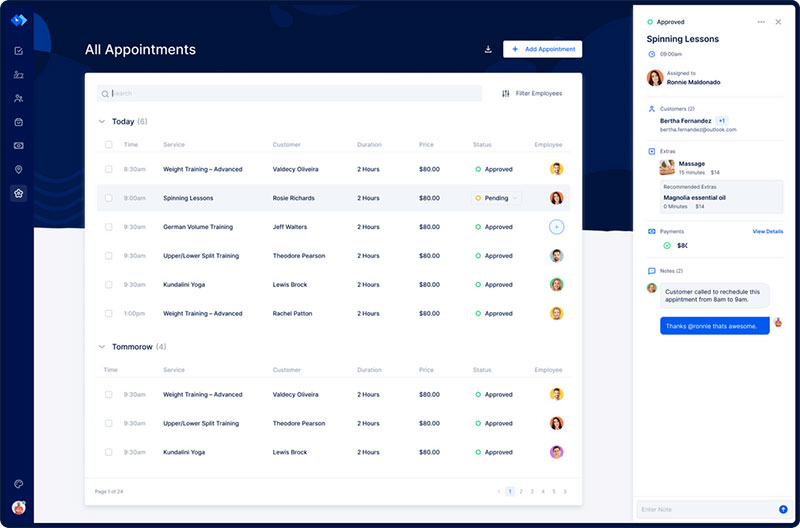

Your success story starts with a scheduling app to streamline your calendar

Staying organized has never been easier.

You can now manage your business and grow your brand with a single, powerful software that keeps all of your appointments in line, your clients organized and your business booming.

Trafft is perfect for business owners who need to streamline their booking experience both for their staff and their clients.

Trafft handles everything for you, even sending automated email or SMS reminders to your clients. No-shows? Not anymore!

The Trafft booking software adapts to different industries for a blissful online booking experience and employee management.

Want to know more? Check out Trafft’s awesome features to see what you are missing.

Finalize Legal Documents and Contracts

Once you have your broker and have approved the offer, you’ll want to wrap up the deal! This part can get somewhat tangled. It is recommended that you use a lawyer to untangle it. Find a lawyer that is adept at contract law.

The following is a list of a few standard legal documents and contracts used when selling a services business:

- Security agreement

- Asset listings

- Guidelines for use of website and domain name

- Non-compete agreements

- Purchase agreement

- Bill of sale

Could you put together a purchase agreement and contract on your own? Yes. Is it advisable? No. Since these contracts are at least 25-50 pages, there is the possibility of fumbling over crucial details. This could leave you exposed and vulnerable.

As soon as this process is successfully completed, just sign and initial.

How Much Does It Cost to Sell a Business?

A broker will receive a commission of 10-12% for a services business with a value under $1 million. As a business owner makes their service business as marketable as possible, they may accumulate some extra costs, like marketing services and attorney’s fees.

Another fee to keep in mind is the cost involved in transferring the lease of a business to the new proprietor.

How to Sell A Service Business: The Bottom Line

Selling a service business can be an overwhelming process, for the prospective buyer, and even more so, for the current business owner.

It requires patience as it is a time-consuming process. All parties involved need to keep a pragmatic perspective on what to expect regarding the time frame and price.

There are instances where an entrepreneur might decide to delay finalizing the sale. This is a smart move that allows for the business to increase its earnings and put their financial records in order. In the end, a company that is flourishing, blazing trails in the industry, and turning a good profit is very attractive to a prospective buyer. When you follow the correct steps to sell a service business you will ensure you get out of it exactly what you put into it, maybe more.

FAQs about selling a service business

1. What is the best way to determine the value of my service business?

A thorough study of your financial data, including income, costs, and profits, as well as an assessment of your company’s assets, liabilities, and market demand, is the best approach to ascertain the value of your service business.

To obtain an assessment of your company’s value, you can also think about using online tools for valuation or employing a qualified business assessor.

2. How can I make my service business more attractive to potential buyers?

You can concentrate on developing a strong brand, creating a devoted clientele, enhancing your financial performance, and streamlining your processes to boost productivity and profitability to make your service business more appealing to prospective purchasers.

You can also draw attention to any distinctive selling factors or competitive advantages that set your company apart from rivals in the industry.

3. What are some common mistakes to avoid when selling a service business?

When selling a service firm, frequent pitfalls to avoid include not gathering financial records and other necessary information adequately, failing to maintain confidentiality during the sale process, setting an unreasonable asking price, and failing to communicate clearly with possible purchasers.

4. Should I hire a business broker to help me sell my service business?

As business brokers are experienced in navigating the sales process, marketing your company to potential buyers, and negotiating the terms of the sale, hiring one to assist you in selling your service business might be advantageous.

Yet, it’s crucial to thoroughly assess prospective brokers to make sure they have the skills and credentials necessary to suit your demands.

5. What should I consider when negotiating the terms of the sale?

It’s crucial to take into account details like the purchase price, payment schedule, financing alternatives, transition period, and any guarantees or contingencies that might be included in the sales agreement while discussing the conditions of the sale of your service business.

Working with a lawyer will help guarantee that the terms of the sale are reasonable and enforceable under the law.

6. How long does it typically take to sell a service business?

Depending on variables including market demand, business complexity, and the effectiveness of the sales process, the time it takes to sell a service firm might vary.

From listing the business for sale to finalizing the deal, the sales process can often take several months to a year or more.

7. What documents and information do I need to prepare before selling my service business?

A variety of financial and legal documentation, such as tax returns, financial statements, client contracts, personnel records, and any necessary licenses or permits, should be prepared before selling your service firm.

To help draw in potential customers, you might also need to create a company plan or marketing materials.

8. What are the tax implications of selling a service business?

The tax ramifications of selling a service firm can be complicated and depend on a number of variables, including the acquisition price, how the sale is structured, and local tax regulations.

Working with a skilled accountant or tax professional is essential if you want to fully comprehend your tax liabilities and make the necessary plans.

9. How can I maintain confidentiality during the sales process?

Confidentiality must be upheld throughout the sales process in order to safeguard your company’s reputation and stop potential rivals from learning sensitive information.

Working with a trustworthy broker, requesting non-disclosure agreements from possible buyers, and restricting access to sensitive information are all ways to safeguard confidentiality.

10. What are some tips for transitioning ownership of a service business to the new owner?

Making a thorough transition plan, communicating clearly with staff and clients, giving the new owner training and support, and making sure that all financial and legal obligations are fulfilled during the transfer of ownership is some advice for transitioning ownership of a service business to the new owner.

If you liked this article on how to sell a service business, you should also check out this one with service business websites.

We also wrote about similar topics like how to market a service business, how to scale a service business, how to run a service business, service business vs product business, service business with low startup costs, and services landing page designs.