If you are looking to start a consulting firm, you’ll need a sound consulting business plan to succeed. But what makes a business plan so important? Why should you take the time to compose one? And how can you do it?

This article will guide you in understanding the need to develop a business plan. You will also explore the various funding channels for organizations offering consulting services. Then, these resources will help you create a structured plan that represents your company.

Lastly, you will get a reliable example of a consulting business plan template.

But first, keep reading to learn what this crucial document really is and how it adds to your company’s value.

The Consulting Business Plan—What Is It?

Consulting business plans are essential tools for managing any organization. They are much more than the elements you need to receive different types of funding like bank loans. These documents present a company’s current status within a logical structure.

Business plans analyze the company’s position in the market, target audience, and operations. They focus on defining clear objectives and accurate projections that will guide the business. Also, these plans include detailed budgets that define how the company should act and divide its funds.

Thus, business plans approach all departments, from Human Resources to Marketing and Finances. Over time, review and update your plan to portray your new business situation, characteristics, and goals. This way, it becomes a living document that fosters sustainable growth.

Why You Should Write a Consulting Business Plan

A business plan is a comprehensive document and a tremendous resource for your company. It allows you to create a reliable business model and adjust it according to your needs.

It should include your short and long-term goals, describe your ideal client, and detail your marketing plan. In most cases, this plan is a requirement for bank loans and other funding requests.

In truth, this key asset will only be as valuable as it is updated. Thus, you must use it to assess your business situation every quarter, trimester, semester, or year. After these evaluations, your plan requires proper revising to continue viable.

By doing so, you might take advantage of its functionalities for an indefinite period. No matter if you grow your operation, restructure it, or go through various market changes, your business plan will provide the needed support for you to succeed. The following are the foremost advantages of a business plan for your consulting firm.

Five Advantages of Business Plans for Consulting Firms

For Your Market Positioning

The plan should explain what your consulting business offers to potential clients. It describes how to approach the problems you face and details if you act on a niche or a broader segment. This way, it defines where you place yourself in the market and presents your unique selling proposition (USP).

For Your Target Market

Preparing your business plan requires thorough research to define your target customers. You must determine which consumers need your services.

Then, you ought to understand when, where, and how to reach that audience. You might need to use different channels and develop more than one value proposition.

For Purposeful And Fruitful Marketing

After defining your ideal clients, you can use the information gathered to work on your marketing mix. Then, develop a program to reach prospective clients and generate conversions.

In this case, the business plan will help you structure purposeful strategies to attract clients. You must also remember to set up tactics to retain clients in your client base, growing it over time.

For Clear and Achievable Objectives

One of the best approaches to goal setting is the SMART method. SMART stands for specific, measurable, achievable, relevant, and time-bound.

Following these criteria will help you refine your picture of success. The business plan records your goals and helps track progress, enabling you to realign your strategies when needed.

For Accurate Financial Predictions and Efficient Fund Allocation

Maintaining steady control of finances is critical for a business consulting operation. A business plan is especially advantageous for fund management. From the launch of your organization, it helps you understand how much you will need to invest.

It also enables you to accurately project how much volume of business and revenue to expect. In it, you can build a comprehensive budget with the most relevant financial statements. It should include the balance sheet, the income, and the cash flow statements.

Funding Channels for Businesses Offering Consulting Services

Consulting firms, specifically small businesses, must be mindful of their available funding channels. Properly financed operations are on the path to success. Yet, to receive the needed support, the management consulting business plan is almost always required.

It maps your organization’s direction and details its performance and future accomplishments. You might intend to ask for a loan through your business bank account or request other companies or partners for extra funds.

Either way, your plan will inform them of the risks involved according to your financial status and solvency. Capital raising varies with the consulting business size, objectives, and legal structure. Consider three standard options.

Retained Earnings

Retained earnings are a low-cost funding channel for consultants and businesses alike. They can distribute them among investors or reinvest them into the business. They can also use them to provide services that attract more clients.

By definition, these earnings amount to the remaining value of the net income after settling all expenses and obligations. Thus, they might prove insufficient to support your consulting firm.

Debt Capital

Businesses providing consulting services might also apply for bank or investor loans. This type of funding is debt capital. Another approach to it is issuing financial instruments, namely debt securities. There are different kinds of debt securities, from commercial papers to bonds and warrants.

This channel allows companies to receive considerable funds. Yet, they must return the amount loaned plus interest within a preset timetable to avoid repercussions.

Equity Capital

In equity capital, businesses sell a stake of their ownership to third parties, whether it be other organizations or investors. If you opt for this funding channel, you will not have your company’s sole proprietorship. At the same time, you can benefit from your investors’ contact network and expertise.

Small businesses and startups, for example, often rely on angel investors to grow. Of course, this also means they suffer added pressure to prove successful and generate a high return on investment (ROI).

Resources for Composing a Business Plan

You can easily find many valuable resources for writing your own business plan. For example, you can use the Starting a Business: License and Permit Checklist from LegalZoom to ensure compliance.

Bplans has business plans for various industries. You can use them as inspiration or create your own through their software, LivePlan.

The U.S. Small Business Administration (SBA) has a business plan template in two versions. You can choose whichever suits your needs best and access practical examples. Their website answers common consulting business plan FAQs to help you achieve consulting success.

They also have a page to help you Register Your Business and one for defining the best strategies to Fund Your Business. Regarding funding, SBA.com has an insightful article entitled Government Small Business Loans.

Example of a Consulting Business Plan Template

Now, you have learned the importance of the business plan for a successful consulting business. Below is a template example that may align with your company’s needs and goals.

Executive summary

The first section in your management consulting business plan is the executive summary. Because it outlines your content, you will only write this page-long portion after finishing the document. You can include subheadings for the most significant subjects and compose their overviews.

Your text should be engaging, concise, and contain relevant information without being overly dense or technical. Here, you can use a text summarizer to write an executive summary for the business plan. It will help you automatically write concise and engaging summaries without any effort. You just need to pass the business plan through the tool and it will provide you with a summary that you can use along the business plan. Executive summary is a critical component of your plan. Investors and lenders with little time might resort to it to decide if they will further analyze your business plan.

Industry analysis

One of the goals in writing your business plan is to define your market positioning accurately. Industry analysis will help you detail the current size of the market in which you have inserted yourself.

It highlights your segment’s opportunities, trends, and challenges. Then, it correlates them to your business. This research gives you an insightful look into your competitors.

Operational program

Here, you will relate your company’s daily activities. You must introduce your internal structure and portray the role of your consultants and other staff members. Name current partnerships and identify potential future ones.

You can include details about the available equipment, technology, and buildings. Plus, outline company policies regarding clients, consultants, service quality, operational procedures, and management.

Management team

You can include the management team in a separate section or embed it in your Operational Program. Regardless, it should describe your management team members, including their duties and roles. Even if you are working alone or are the sole manager of your business, you must describe your part thoroughly.

Also, create a chart of your management hierarchy or workforce according to your company size. Develop projections to clarify your plans. Additionally, define the number of employees and a hiring schedule.

Competitive analysis

In this section, you will analyze your competitors. It is one of the most critical stages of the business plan. You should observe three main criteria:

- Differentiation: Study what your competitors highlight as differentiating factors in their consulting services. Then, it will be easier to emphasize your distinctive service features and stand out in the market.

- Cost Leadership: You must examine the prices practiced by other consultants. The goal is to find a price lower than the competition that will increase your profit.

- Market Segmentation: You might return to your industry analysis to focus on a niche that grows your business.

The SWOT analysis

The SWOT analysis is a strategic framework essential for any successful organization. It helps you identify the strengths, weaknesses, opportunities, and threats of your consulting business.

Strengths will focus on your advantages as an independent consultant or those of your operation. You might mention your reputation, expertise, or clientele. When you examine your weaknesses, look at where you lack distinctiveness, resources, or influential clients.

Then, you will address market opportunities through niches, trends, or collaborations. Finally, when looking for threats, scrutinize the current economy, regulations, and your competitors.

Available services

As a consultant, you have a niche range of services you provide to your clients. Contrarily, you might have consultants working in various market segments if you own a firm. In this section, list your available services and explain them in detail.

Describe the issues you approach and why potential clients should choose to work with you. Then, you must present satisfactory results.

Define the qualitative and quantitative value your services have brought to your operation. Finally, you should develop a three-year plan to grow or solidify your present offerings.

Customer analysis

In customer analysis, you will define your ideal client and strive to understand them deeply. This process involves researching past, current, and future behavior trends. Examine their quantitative and qualitative features and draw specific conclusions from that data.

At first, you might think accepting every customer that resorts to you is a good policy because it results in more money in the short term. Yet, filtering your clients will help you build a sturdy reputation and keep a competitive position in the market.

Besides, it will allow you to develop more purposeful marketing and boost your prospects. In time, these strategies will lead to added value and increased revenue.

Marketing plan

Your marketing program is a vital part of your business plan. With it, you establish a logical strategy to reach and captivate your ideal client. You must evaluate the issues that bind with your customer analysis to foster an efficient sales process.

Define accurate KPIs (key performance indicators). This way, you can easily track your results and readjust your marketing campaigns if necessary. Consider your niche, services, pricing, and sales and publicity channels. Environmental consulting, for example, will differ from human resources consulting.

You might also employ various marketing materials and techniques. Email marketing usually includes more written content, while social media marketing emphasizes images.

Financial projections

You will present financial projections at the end of your management consulting business plan. It includes your current results, funding needs, and economic strategies.

There are three principal documents to include in your business financial plan. You might want to add other complementary papers that support your data or provide further context. The principal documents are

- The Balance Sheet: is a compilation of your assets and liabilities. The difference between those values equals shareholder equity.

- The Income Statement: is also called the profit-and-loss (P&L) statement. It contains your business revenue and expenses to calculate your final income.

- The Cash-Flow Statement: is similar to the income statement but specifies the source and date of money entrances and exits. Positive cash flow is a requirement for business growth.

Budget for business and workflow automation tools

Software tools that bring automation to your business and work processes are becoming increasingly popular. Few companies hire employees for simple, routine tasks if they can use tools instead. So it is advantageous to set up a budget that allows your consulting business to embrace them.

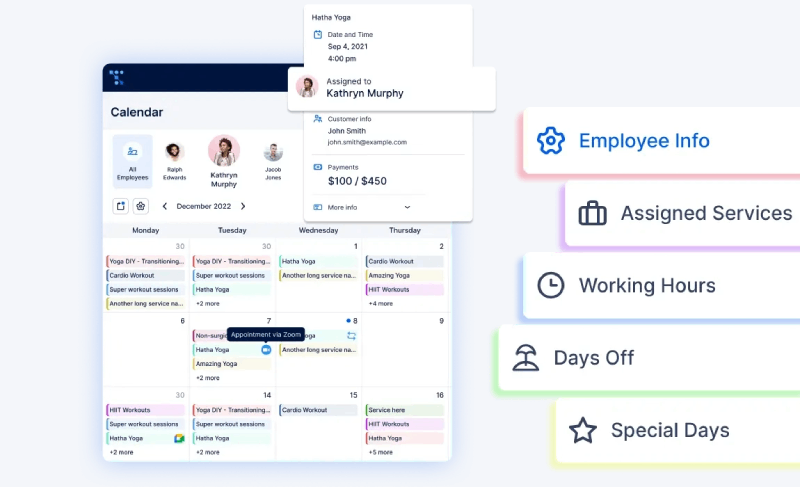

After all, they provide extra security and show that you keep up with current trends and technologies. In this case, Trafft provides a solution that takes management consulting to the next level. It improves productivity and reduces or eliminates human errors.

How?

Thanks to its fantastic features and benefits.

Trafft’s features

- Effortless Scheduling

Forget about never-ending email chains or back-and-forth texts. With Trafft’s sleek scheduling system, your clients can book appointments directly through your personalized booking page. Just set your availability, and you’re good to go! It’s a game-changer for managing your time. - Time Zones? No Problem

Are your clients scattered across the globe? Trafft’s got your back. The platform automatically adjusts to your clients’ time zones, so you can say goodbye to confusion and missed meetings. Super useful if you run an online consulting company. - Stay in Sync

Worried about keeping track of all your appointments? Trafft syncs with your favorite calendar apps like Google Calendar, and Outlook. Your schedule stays up-to-date, and you’ll never miss a beat. - Customization Heaven

Want to match your booking page to your brand? Trafft lets you customize the look and feel to your heart’s content. It’s your brand, your rules. - Reminders and Follow-ups

No more chasing clients for confirmations or worrying about no-shows. Trafft automatically sends reminders and follow-up messages via email or SMS, ensuring that everyone’s on the same page.

So, what does this mean for you? With Trafft, you can:

- Maximize Efficiency

Spend more time doing what you do best – providing stellar consulting services. With Trafft, you’ll free up precious time by automating appointment scheduling and reminders. - Boost Your Professional Image

A slick, personalized booking page will elevate your brand and make your business stand out from the competition. - Reduce Stress and Confusion

Stay organized, punctual, and stress-free with a system that handles all the scheduling details for you.

So, what are you waiting for? It’s time to level up your consulting game and revolutionize your workflow. You can try Trafft for free today and experience the magic for yourself.

Appendix

The final part of a business plan is the appendix. In this supplementary section, you can include any additional information. Its goal is to strengthen and support the content you have presented in previous pages. It might feature industry research, legal information, or testimonials from clients and employees.

The appendix is your opportunity to emphasize why the strategies defined in your plan are sensible. It should have valuable data that adds to your credibility. It backs and builds its reputation for investors, new clients, and other consultants and institutions.

FAQ on Creating a Consulting Business Plan

What’s the purpose of a consulting business plan?

Well, a consulting business plan is essential because it helps you define your business objectives, target market, and overall strategy. It’s a roadmap that outlines your goals and provides a clear direction for your business, so you can stay on track and measure your progress.

Additionally, if you’re looking for investors or loans, a solid business plan will demonstrate your expertise, competence, and commitment to potential funders.

How do I identify my target market?

To identify your target market, you need to think about who could benefit from your consulting services.

Start by analyzing the industries and sectors that you have experience in or are passionate about. Look at the potential clients within those areas, and think about their pain points, needs, and desires. Once you’ve narrowed down your target market, you can refine your marketing and sales strategies to effectively reach and serve those clients.

What should I include in the services section?

In the services section, you’ll want to describe the specific consulting services you plan to offer.

Consider the problems you’ll help clients solve and the outcomes they can expect. Be sure to detail your unique value proposition – what sets you apart from other consultants in your field.

Also, consider including various service packages, pricing structures, or options for customization, as this will demonstrate flexibility and cater to a broader range of clients.

How do I set my pricing?

Pricing your consulting services can be challenging, but it’s important to strike a balance between your worth and what the market can bear. Research your competition and consider factors such as your expertise, the value you provide, and the complexity of the projects.

You can use hourly, project-based, or value-based pricing models. Don’t sell yourself short, but also be aware that overpricing can deter potential clients.

What marketing strategies should I use?

To market your consulting business, leverage a combination of traditional and digital marketing strategies. This might include networking at industry events, cold calling, email marketing, and creating a strong online presence through a professional website and social media platforms.

Content marketing, like writing blog posts or whitepapers, can also showcase your expertise and establish you as a thought leader in your industry. Don’t forget to ask for referrals from satisfied clients!

How do I create financial projections?

Creating financial projections is a key aspect of your business plan, as it helps you anticipate future revenue, expenses, and cash flow. Start by estimating your expected income from clients, considering factors such as your pricing, target market size, and anticipated conversion rate.

Then, outline your anticipated expenses, such as office rent, equipment, marketing, and taxes. Finally, create a cash flow statement to ensure you have enough working capital to cover your expenses and grow your business.

Should I include a SWOT analysis?

Including a SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis in your consulting business plan is definitely a good idea. It helps you take a comprehensive look at your business and understand the internal and external factors that could impact your success.

This analysis can inform your overall strategy, allowing you to capitalize on your strengths and opportunities while addressing your weaknesses and mitigating potential threats.

What legal aspects should I consider?

When starting a consulting business, it’s crucial to consider legal aspects like business structure, licenses, permits, and contracts. Choose the appropriate legal structure (e.g., sole proprietorship, LLC, or corporation) based on your personal and financial needs.

Ensure you have any necessary licenses or permits to operate legally. Additionally, develop standard contracts for clients that outline the scope of work, payment terms, and intellectual property rights to protect both parties.

How do I measure my success?

To measure the success of your consulting business, establish key performance indicators (KPIs) that align with your goals and objectives. Common KPIs for consulting businesses include revenue growth, client acquisition and retention, project completion rates, and client satisfaction.

Regularly track and analyze these metrics to evaluate your progress and identify areas for improvement. Additionally, consider using client feedback and testimonials to gauge the quality and impact of your services on their businesses. This will help you continuously refine your offerings and maintain a competitive edge.

Conclusion on How to Write a Consulting Business Plan

A management consulting business plan is a crucial tool for any organization. This guide showed how this comprehensive map affects operations. Companies in the consulting industry should be able to position themselves in the market.

They need to understand their ideal client and find ways to reach them, turning prospects into conversions. A purposeful marketing plan that embraces different communication channels is also essential.

Besides, businesses must track their financial situation and know the available funding channels. With these resources, you can write an excellent business plan and set yourself up for consulting success.

Ready to Dive in for More Fun?

Check out these extra resources to uncover all the details about the consulting business:

- How to Start an Online Consulting Business: The Complete Guide

- How to Become an Independent Consultant

- Management Consulting vs. Strategy Consulting: What’s the Difference?

- Boutique Consulting Firms: Everything You Need to Know

- Online Consulting: Everything You Need to Know to Be Successful

- How to Become a Tax Consultant and Be Great at It

- What is a Business Automation Consultant and How You Can Be One