Many people don’t know it, but they can include their service business expenses in their accounting records. This includes the electricity from your home office, commuting expenses to the post office, and others.

Thus, it becomes vital to register all expenses that may be tax deductible. This will serve as proof for the IRS and help you keep track of your cash flow.

So, how do you know what qualifies as tax-deductible business expenses? Simply ask yourself: Are these business expenses ordinary and necessary to carry out my activities? These are the two elements that the IRS will require from you.

Ordinary and necessary expense categories

- Ordinary expenses are the ones that are commonly accepted in your line of work.

- Necessary business expenses are the ones that help you run your operations.

Below is information on deductible expenses that may help you optimize your company’s taxes.

Tax Deductible Service Business Expenses - What Are They?

When you run a company there are certain expenses that are tax deductible. Nonetheless, there is not one single list that specifies what qualifies as such. To deduct certain expenses from your taxable income, you’ll have to prove that they are ordinary and necessary. So, this must be the basis on which business owners do their taxes.

All common business expenses are deductible. This includes equipment, office supplies, salaries, utility costs, rent, business cards, accounting, and legal fees.

This applies to both traditional and digital businesses - for instance, ecommerce taxes and related online transaction fees follow similar deduction principles when properly documented.

The more tax deductions you gather, the lower your taxable income will become. Keep in mind that you must do this carefully and keep all of your records. You must have these available in case you’re audited by the Internal Revenue Service.

Common Business Expense Categories for a Service Business or Startup

At the risk of sounding obvious, the first thing you should do is keep your monthly bookkeeping properly. By keeping accurate records, you can control your cash flow and prove that your tax deductions are legal.

However, in the service business industry, this process can be more challenging. The following are some examples of activities that are partly or fully deductible.

Advertising costs

Advertising is fully tax deductible. This applies to campaigns both on social media and traditional media, like newspapers.

Whatever money you spend on posters, billboards, websites, promotional materials, and social media images counts as business expenses.

Education

If you take workshops or lessons to improve your skills, this is tax deductible. This is only applicable if the education is focused on topics that are relevant to your business.

Such a deduction applies only if you will obtain a certification from the given course, for example, Certified Social Media Consultant.

Simpler courses also fall under the term “business expense categories”. This even includes photography training to take better pictures of your products.

Bank fees

It’s always a good idea to keep your personal and corporate finances and accounts separate, including credit cards.

Thus, you can deduct both annual and monthly expenses from credit cards and banking fees. Transfers and overdraft fees are also tax-deductible. This includes transfer fees from online payment gateways like Stripe or PayPal.

Professional fees and legal expenses

In some cases, you’ll need to hire accountants or attorneys. Thus, you can deduct expenses related to their tasks. On the other hand, if you acquire business assets, you can’t deduct professional fees. Instead, these business expenses are added to your taxable income.

Magazine subscriptions

Business owners can subscribe to magazines with related topics and deduct the expenses. It’s worth noting that media with general information does not fall under business expense categories. It must be related to your specific niche.

Office expenses and office supplies

Everything from notebooks to cleaning products to snacks and beverages for employees is considered a business expense. This includes website costs like hosting providers and accounting software.

Home office expenses

If you work from home you can also deduct some business expenses. In this case, you must use your home office regularly and exclusively for work. You can make your home office your main business center and even use it to meet clients.

In line with this, you can consider repairs deductible expenses. For example, fixing a broken window in your office is deductible.

Utilities

Additionally, if you have your office outside your home, you probably pay utilities. You can deduct gas, phone, water, and city services. In some cases, these business expenses are included in your rental agreement.

For home offices, the situation is different. Business owners cannot deduct fixed expenses like the phone landline. However, you can deduct the cost from a second line within the same home.

Lease payments

Leasing is considered a business expense, as are other costs related to the leasing of commercial premises or buildings. Keep in mind that these are tax-deductible expenses only at the time of payment.

Employees’ salaries

You can deduct salaries and several employee benefits, including paid vacations. The deduction applies under certain circumstances:

- The employee cannot be a partner, an LLC member, or a sole proprietor.

- The salary must be reasonable and meet the criteria of ordinary and necessary.

- You must prove that the employee provided the required service.

Employee compensations include

- Awards

- Payroll

- Bonuses

- Salaries

- Paid vacations, sick leaves, and health insurance

Meals

Your business meals are deductible by 50% on certain types of food and beverages. Businesses are eligible for these deductible business expenses if

- The expenses fall under the category of ordinary and necessary for business operations.

- The acquired meal is not extravagant.

- The owner or an employee is present at the meal.

Not all expenses qualify for this category. Additionally, you can deduct 100% of the meal cost if you provide meals to your employees, for example, if they are working late.

Vehicles and commuting

It’s important to keep personal and business expenses separate. This is especially tricky when it comes to vehicles. There are two ways to manage your deductible service business expenses. You can either account for mileage or costs. The latter includes regular business expenses like oil, gas, insurance premiums, and others.

Moving

When moving to a new location, you can deduct as much as 100% of these business expenses. Keep in mind that the new working place must be at least 50 miles from the previous location.

Depreciation costs

Some business assets will be with you for a long time. This includes equipment, furniture, and similar items. There’s a depreciation rule that allows you to write off the costs incurred in the long term. The other option is to ask for tax deductions for the full cost at once.

The second option gives you a more immediate benefit. However, you can choose any of the options provided by the Internal Revenue Service.

Startups

New businesses can deduct up to $5,000 as an incentive when they launch. Some of these service business expenses are for marketing and employee training costs.

Interest payments

Interests are deductible business expenses. During a given tax year you can deduct the payments you make related to your debts. This can mean significant cost savings since you can deduct, for example, tax on your bank loan interest.

A small business owner probably starts with a credit card to face the initial costs. The good news is that these interests are also deductible.

The principle also applies to mortgage interest for buildings or other real estate.

Debts

If a customer doesn’t pay you for a product that you already delivered, it can be detrimental. The term to describe these situations is “bad debts”. These are cases in which the person refuses to pay even after several statement reminders.

In other words, bad debts are money that you can’t collect for whatever reason. They also count as business expenses for the Internal Revenue Service.

Software

Business accounting software or SaaS subscriptions are tax-deductible business expenses in some cases.

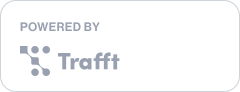

You can even deduct Trafft - the booking software you've been waiting for

Trafft is perfect for business owners that are looking to provide a seamless booking experience to both their customers and their employees.

This powerful software helps you manage your business, your clients, and your staff with ease. You'll finally have enough time to fully focus on growing your brand.

Reduce last-minute cancellations and no-shows with Trafft's automated reminders. Enable customers to book recurring appointments and increase the returning customer rate.

Trafft is designed to fit the needs of your particular business. No matter what industry you're in, Trafft will take care of every scheduling need you might have.

Curious? Take a look at Trafft's powerful features to see what you are missing.

Business insurance

Depending on your line of business you will need different types of insurance. A business can deduct casualty, liability, vehicle, or theft insurance premiums.

Medical costs

The Internal Revenue Service also offers incentives for self-employed individuals. In this case, they can deduct medical expenses from their returns, including prescription drugs and professional fees.

Other types of tax deductions

There are other options for taxpayers that want to optimize their activities:

- Your state can tax you on personal property.

- If you use a given land for your business, in many cases you can deduct the real estate taxes. If you are eligible for the home office tax benefit, you can deduct a part of your real estate tax against your gross revenue.

- You can deduct sales taxes if you pay for services related to your business. However, if the tax qualifies as depreciable, you have to add it to the asset basis.

Donations

The Internal Revenue Service allows you to deduct your expenses if you do charity. A charity box in your store can help you. Another option is to use a company vehicle to do volunteer work, like delivering meals.

Pensions

If you contribute to your employee benefits programs, like retirement accounts, this is deductible. In case you don’t have any, there’s always the choice to consult with a tax advisor.

Sole proprietors’ contributions are not considered service business expenses. But you can write them off your gross income thus reducing your taxable basis.

Final Thoughts on Service Business Expenses to Include in Your Tax Return

Minimizing your tax rates is important and can make a difference for your business in the long term. Deductions are the ideal solution, as long as you keep accurate records. Keep in mind that the IRS can come knocking at your door at any time.

Both small businesses and large enterprises can write off certain expenses. This applies to all industries.

A great source to understand what service business expenses are deductible is the IRS Publication 535. Here you’ll find everything you need to know about the types of business expenses that can help you save on taxes.

If you enjoyed reading this article about service business expenses, you should read these as well:

- What is a Business Automation Consultant and How You Can Be One

- How to Start an Answering Service Business

- Service Businesses Examples to Inspire You to Start One