This world is full of unforeseen events. Insurance provides protection, financial security, and peace of mind despite unexpected incidents.

Almost every business needs an insurance policy and beauty salons are no exception. Despite best efforts accidents still happen in a beauty salon.

A beauty salon should have insurance when it opens to protect it from unfortunate events.

What insurance does a salon need? What kind of salon insurance should you invest in? What is the cost of salon insurance?

Find the answers to these questions in the following article.

Why Do Beauty Salons Need Insurance?

Many things can go wrong in a salon. Although hair stylists and other salon workers are very careful, accidents happen.

Accidents can happen to the owner, clients, employees, or even to the physical building. Salon insurance protects against potential losses in the event of damages.

It helps pay costs in the case of a lawsuit. It also helps pay for the repairing or replacement of damaged equipment.

Without insurance, salon owners would have to pay these costs out of pocket. Incurring these expenses could prove fatal to the business or end the career of a stylist.

Salon insurance is key to reducing risk and protecting your livelihood.

Nobody can predict if or when an accident will happen. So salon owners and workers need to plan ahead for the likelihood of an accident.

Salon owners need to protect themselves, employees, clients, and property. They must have the right insurance to guarantee protection.

What Insurance Does a Salon Need?

In general, a beauty salon needs the following insurance policies:

- General Liability Insurance

- Commercial Property Insurance

- Professional Liability Insurance

- Product Liability Insurance

- Workers Compensation Insurance

Thank you for subscribing. Check your mail for details

Types of Beauty Salon Insurance

General Liability Insurance

General liability salon insurance covers mishaps that can happen at work. For example, if a customer slips and falls.

If the customer files a lawsuit, a liability policy covers medical expenses, legal defense, and settlement costs.

A salon is not required by law to have liability insurance. But operating without it puts the owner at great risk.

This is especially true as people are quick to file lawsuits. If a salon does get sued, it could cost thousands of dollars in settlement and lawyer fees.

A general liability policy prevents this type of event from devastating the business.

If a hairstylist sees clients in their home, they still need general liability insurance. A homeowner insurance policy does not cover business activities.

Commercial Property Insurance

Commercial property insurance is also known as commercial property and casualty insurance.

It covers your property in the event of physical destruction. For example, a fire, theft, plumbing incident, or a storm.

It covers the contents of the salon such as chairs, tanning beds, and other equipment. It also covers exterior fixtures associated with the business like a sign or a fence.

This policy covers the loss of expenses while something is getting repaired.

This policy is useful for hair salons in many ways. It can help with the unexpected cost of replacing an expensive hood hairdryer.

Or if a pipe breaks and damages tanning beds, this policy will cover the price of the tanning beds, the work to fix the pipe, and the loss of revenue from the tanning beds being out of commission.

In general, commercial property insurance does not cover flood or earthquake damage. If a beauty salon is in a flood or earthquake area, owners need to add that to the coverage or have a separate insurance policy to cover those risks.

Commercial property insurance also does not cover plate glass walls. Salon owners will need to add it to the policy if they have it in their salon.

Business Owner Policy

Some insurance companies offer a Business Owner Policy. A business owner policy combines general liability and commercial property insurance.

It covers liability claims and property damage. It can also include additional coverages selected by the policyholder.

Combining insurance policies is a cost-effective option and is easier to manage. Those with a business owner policy do not need additional general liability insurance.

Professional Liability Insurance

This coverage is also called errors and omissions insurance. It protects the business from claims of negligence.

It covers claims of bodily injury or damage due to mistakes in performing your professional services. This policy covers damages caused by things that you did do or things that you should have done but didn't.

Examples of when this coverage protects a salon:

- A hairstylist makes a mistake while cutting or coloring a client's hair.

- A client has a reaction to hair coloring. Even if the client said they did not have any allergies and the hairdresser applied the coloring according to instructions, the client can still bring a lawsuit.

- A client loses hair due to overprocessing.

- A massage client is experiencing pain and claims that the massage therapist did something wrong.

Professional liability insurance protects a salon from these situations and more.

Do beauty salon owners need both general liability and professional liability? The short answer is yes.

General liability protects against injury or damages that occur on the salon property. Professional liability protects against injury or damage caused by the professional services provided.

A salon has both of these risks and needs both insurance policies.

A common practice is for salon owners to rent out spaces to individual stylists. If this is the case, the general liability policy may not cover this stylist.

It would be wise for a salon owner to require that stylists have a professional liability policy. This protects the stylist, the salon owner, and the business in the event of a lawsuit.

Product Liability Insurance

Product liability insurance is another good policy for salons to have. This beauty salon insurance protects the business if they sell products.

A faulty product can cause damage or illness to a client. The salon still may be liable even if they did not manufacture the product.

If a client files a lawsuit against the salon because of a faulty product, a product liability policy will cover the cost of compensation claims.

Workers Compensation Insurance

Workers' compensation insurance is a requirement in most states. It protects employees when an injury or illness occurs on the job.

It covers medical care and replaces some wages lost during recovery time. If the injured employee sues the salon, this insurance helps cover legal fees.

For beauty salons it protects:

- Stylists

- Assistants

- Receptionists

- Other employees

This insurance is important because employees work with hot objects, sharp items, and chemicals all day. It comes into play if, for example, an employee burns their arm and requires treatment.

A risk assessment will be necessary before purchasing insurance. A risk assessment will identify potential risks and help owners take preventive measures.

After identifying risks, owners will know which insurance will best protect their business.

After choosing insurance policies, make sure you understand what is and isn’t covered. If owners have special circumstances they might need to purchase additional policies.

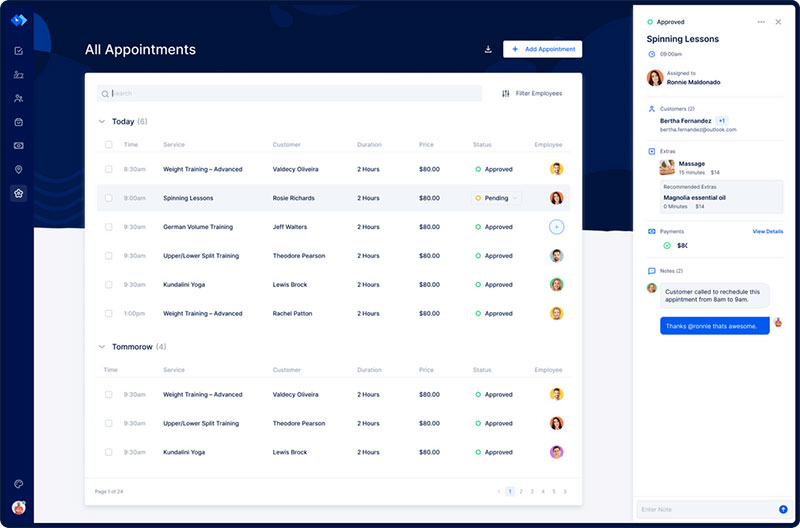

Get more bookings with the right tool for the job

Staying organized has never been easier.

You can now manage your business and grow your brand with a single, powerful software that keeps all of your appointments in line, your clients organized and your business booming.

Trafft is the perfect salon scheduling software for business owners who need to streamline their booking experience both for their staff and their clients.

Trafft handles everything for you, even sending automated email or SMS reminders to your clients. No-shows? Not anymore!

The Trafft booking software adapts to different industries for a blissful online booking experience and employee management.

Want to know more? Check out Trafft's awesome features to see what you are missing.

How Much Does Beauty Salon Insurance Cost?

Good insurance policies cost money. The more coverage a beauty salon needs, the more the insurance will cost.

Top salon insurers look at many factors to determine the amount of and the cost of salon insurance. Factors that affect the price of beauty salon insurance include:

Operations

How an owner runs the business and what services they provide have a major impact on the insurance costs. As an example, salons with tanning beds pay higher premiums than salons without them.

Employees

The amount of employees working in a salon also affects insurance prices. More employees mean more cost for workers' compensation insurance.

More employees also mean a greater possibility of accidents. So the cost for general liability and commercial property insurance also increases.

Revenue

Courts consider income when awarding judgments. Salons with more revenue might have higher premiums.

This is because it costs more for insurance companies to cover them.

Deductibles

Another salon insurance cost factor is the amount of the deductible.

A higher deductible lowers the premium. This is because the salon takes on more financial responsibility.

The lower the deductible, the higher the premium.

Coverage amount

Increasing limits or covering special considerations also increases the overall salon insurance costs. If a salon leases a unique property the price of insurance will be more.

Insurance companies also charge more if a salon has a history of claims.

Location

Certain locations face higher risks.

A salon might be in a neighborhood known for crime, that has extreme weather or is prone to flooding. In those cases, the commercial property premium can cost more.

Full beauty salon insurance can cost as low as $50 a month or as high as $1,000 a month. It all depends on the number of employees, the services provided, and the location of the salon.

The insurance company, the policies, and even the state you live in all affect the cost of insurance. Combining policies and learning about the factors that affect salon insurance will help lower the cost.

Salon owners should also consider the insurer. Check different insurers for reliability.

Find one that offers policies to cover a salon's specific risks.

The Assured Word On Salon Insurance

When a business provides a service to clients, there is always a risk that something will go wrong. Purchasing good salon insurance is vital for hair salons, nail salons, spas, and the like.

Without insurance, a salon owner is liable for legal and compensation fees when an accident affects employees or clients. Or they could face unexpected disasters such as storms, theft, or internal damage.

Salon owners have a lot of worries and concerns. Having full insurance coverage will provide peace of mind.

FAQs about salon insurance

1. What is salon insurance?

The goal of salon insurance is to shield salon owners and their companies against monetary losses that could arise from a variety of occurrences, such as property damage, theft, and liability claims. Most salon insurance plans come with a variety of coverage choices that can be adapted to an individual salon's requirements.

2. Why do I need salon insurance?

You may encounter a number of risks as a salon owner that could perhaps cause monetary losses for your company. Salon insurance can aid in reducing these risks to your company and provide you peace of mind knowing you are covered financially in the event of an unplanned disaster. That's why you should think about insurance as soon as you start writing your business plan.

3. What does insurance cover?

Salon insurance policies typically cover a variety of occurrences, including as liability claims, property damage, and theft. Depending on the policy and service provider, specific options for coverage could include things like general liability, professional liability, business interruption, property damage, and more.

4. How much does insurance cost?

The cost of salon insurance can vary depending on a number of variables, including as the kind and kind of coverage you require, the size of your company, where you are located, and the history of claims you have filed. Salon insurance typically costs between a few hundred and several thousand dollars annually.

5. Can I customize my salon insurance policy?

Indeed, a lot of salon insurance companies provide flexible policies that let you customize your coverage choices to suit the particular requirements of your company. By doing this, you can make sure that your salon is adequately protected without having to pay for unnecessary insurance.

6. What types of incidents does insurance protect against?

Salon insurance can offer defense against a range of occurrences, including liability claims, property damage, and theft. Depending on the policy and service provider, the specific incidents covered may differ, but they could include slip-and-fall accidents, equipment damage, and more.

7. Does insurance cover independent contractors working in my salon?

Depending on the supplier and policies. Independent contractors may be covered by some salon insurance policies, while others may demand that they have their own insurance policy. To learn what is covered by your insurance coverage, it's vital to speak with your insurance company.

8. What happens if a client gets injured in my salon?

If a client suffers an injury while visiting your salon, your liability insurance may help defray the costs of their injury, including any medical bills or litigation costs. Whenever an incident occurs, you should let your insurance company know as quickly as you can.

9. Can I get insurance if I work from home?

Sure, several salon insurance companies provide programs made especially for salons with home offices. Both events that take place on your premises and potential liability claims resulting from your services may be covered by this insurance.

10. How do I choose the right insurance policy for my business?

It's crucial to take into account both your individual requirements and the hazards involved with running your business when selecting salon insurance coverage. You might want to take into account elements like the size of your company, the services you provide, and your location. You can further help guarantee that you have the appropriate coverage choices to safeguard your salon by working with a trustworthy insurance provider.